Housing Market Analysis Empowering Realtors, Homebuyers & Sellers with the Latest Insights: May 16th 2025

Housing Market Analysis Empowering Realtors, Homebuyers & Sellers with the Latest Insights: May 16th 2025

1. Mortgage Rates in a Rangebound Market

Even with daily headlines about inflation, tariffs and fiscal policy, 30-year rates have hovered between high-6% and just under 7%:

-

May 14, 2025 national average: 6.86% (30-year fixed)

-

15-year fixed average: 6.08%

-

Rates have remained “rangebound” despite CPI prints and jobs data

-

Fed’s pause on benchmark changes keeps markets in a “wait-and-see” mode

What this means: Buyers know the range. Competitive pricing and rate-buy-down strategies can keep your clients in the “sweet spot” below 7%

.

2. Strong Purchase Demand Persists

Contrary to many forecasts, mortgage demand continues to hold firm—even with higher rates:

-

New listings have normalized as spring winds down

-

Demand has stayed between 7.25%–6.64% all year

-

Realtor tip: Share this narrative with prospects—rates aren’t chasing buyers away

What this means: Your proactive outreach—daily calls, open houses and targeted social posts—will capture motivated buyers who recognize opportunity in stability.

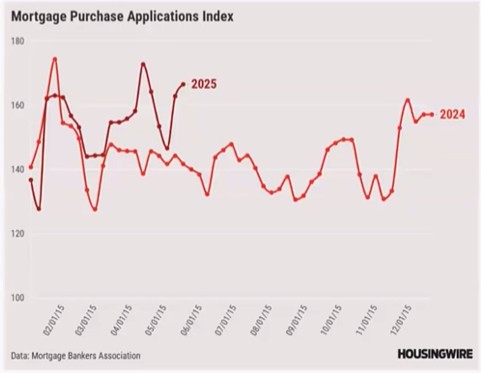

3. Purchase Applications Outpacing Last Year

The Mortgage Bankers Association index shows 2025 purchase applications above 2024 levels in nearly every week:

| Week of 2025 | Relative Index vs. 2024 |

|---|---|

| Early January | +5% |

| February – April | +3–7% |

| Mid-May | +6% |

What this means: Consistency wins. Agents executing daily prospecting routines are riding the purchase-application wave higher.

4. Inventory Is Finally Rising

After four years of record-low supply, single-family inventory is up 33% year-over-year—approaching pre-pandemic levels:

-

More homes for sale = more options for buyers

-

Increased bargaining power: seller concessions, closing-cost credits

-

Seasonal uptick amplified by pent-up listings in high-demand markets

What this means: Now is the time for buyers to act—highlight expanded choices and negotiation opportunities.

5. Turning Insights into Action

Armed with these hard data points, here’s how to leverage them immediately:

-

For Realtors:

-

Share slides #3 (purchase apps) & #4 (inventory) in your next newsletter or social post

-

Host a virtual “Market Snapshot” webinar using these stats

-

Personalize outreach: “Rates steady, demand firm, inventory up—let’s find your perfect match!”

-

-

For Homebuyers & Sellers:

-

Buyers: Emphasize timing—larger inventory means better terms

-

Sellers: Limited competition in some areas still favors quick sales at top dollar

-

Both: Discuss rate-buy-down options and pre-approval strategies

-

6. Schedule Your Strategy Call

Let’s turn today’s market intelligence into your next win. Whether you’re a Realtor looking to energize your database or a buyer/seller ready to make a move, I’m here to help you:

-

Interpret these trends for your specific neighborhood

-

Craft targeted outreach that drives conversations

-

Lock in the right rate with proactive pre-approval and buy-down plans

🔗 Schedule your personalized strategy call with Nate today

Stay encouraged—this is a unique market where informed action pays dividends. Let’s connect and capitalize on the opportunities ahead!

Powered by: Premier lending, Inc.

Host: Nate Carver | NMLS: | LO NMLS: 2004738

📞 972-832-5761 | 🌐 natecarver.com

Licensed by the Department of Financial Protection and Innovation (DFPI). Equal Housing Opportunity.

Comments

Post a Comment